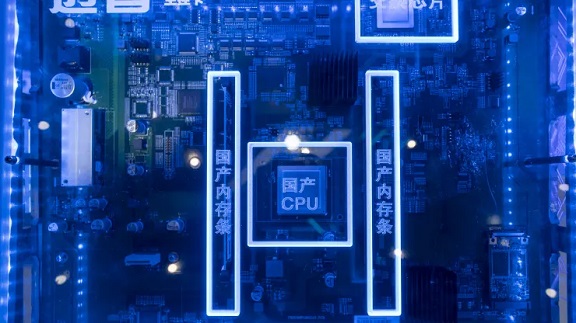

China tech companies are closely watching ChatGPT’s A.I. skills.

Big tech companies in the U.S. and China rushed this month to announce they are working on artificial intelligence tools similar to ChatGPT. Their announcements often referenced ChatGPT, while disclosing few details on what they themselves were work

After a year-long dip, American consumer spending power will be back in 2023

Goldman Sachs expects household cash flow to reverse a year-long decline beginning right after Christmas. Gains will begin small and accelerate through the next year, making up for the recent decline in cash from federal stimulus payments, and that

Toyota to build $1.29B electric vehicle battery manufacturing plant in North Carolina

Toyota has selected North Carolina's Greensboro-Randolph megasite as the location of a new $1.29 billion automotive battery manufacturing plant for its electric vehicles.